SCPI, OPCI, FIA : la meilleure option pour bâtir l’après-coronavirus ?

Face à l’actuelle crise sanitaire, tout investisseur, qu’il soit institutionnel ou professionnel, se doit de garder la tête froide. Le moment est propice pour faire le point sur la situation patrimoniale de ses clients. Comment bien préparer l’avenir qui sera peut-être marqué par une grave récession économique ? Comment faire travailler au mieux l’argent de sa clientèle pour compenser d’éventuelles pertes de revenus par ailleurs ? Parmi les différentes formules de placement susceptibles d’améliorer le pouvoir d’achat figure une solution pertinente, simple et porteuse de sens : l’investissement dans un fonds immobilier.

Même si le fonds immobilier, comme tout investissement, comporte une part de risque (risque de perte en capital et risque de liquidité), celui-ci présente de nombreux avantages par rapport aux autres formes de placement. Contrairement au cycle économique, le cycle immobilier est beaucoup plus long et nettement moins volatil. À l’inverse des marchés financiers plus enclins à réagir immédiatement à la hausse ou à la baisse irrationnelle des actions ou à des événements extérieurs comme ce fut le cas avec le coronavirus, le marché immobilier est connecté à l’économie réelle et résiste mieux à des vagues récessives.

Que choisir : OPCI, SCPI ou FIA en Immobilier ?

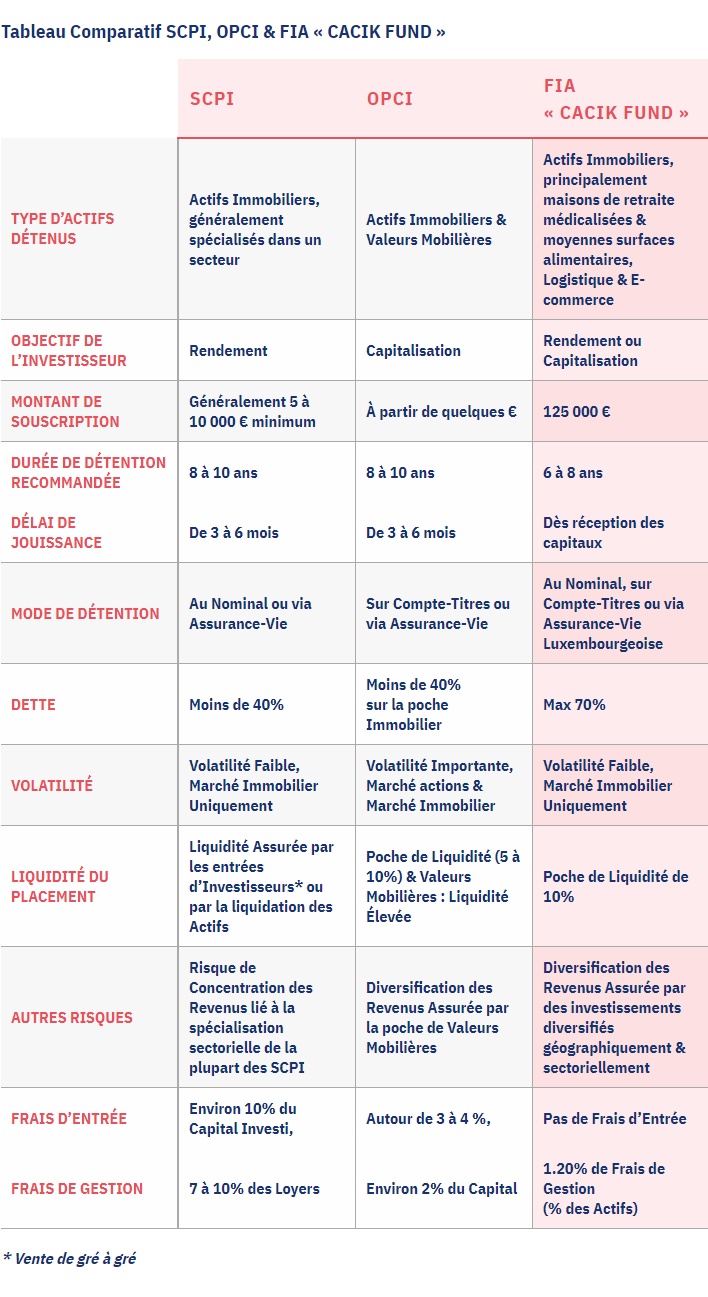

Conçus pour offrir le plus de stabilité possible sur le long terme, les fonds immobiliers constituent une des meilleures options pour bâtir l’après-coronavirus, mais encore faut-il savoir lequel choisir. Il existe actuellement trois principaux types de placement immobilier : l’Organisme de Placement Collectif en Immobilier (OPCI), la Société Civile de Placement Immobilier (SCPI) et le Fonds d’Investissement Alternatif (FIA) en Immobilier. Contrairement aux deux autres catégories, les OPCI ne sont pas des véhicules exclusivement immobiliers. Ils détiennent au minimum 60% d’actifs immobiliers, le reste étant réparti entre une poche de liquidité (entre 5 et 10%) et des valeurs mobilières. Les SCPI investissent le plus souvent dans un secteur immobilier spécifique, généralement les bureaux et les commerces. Les FIA en Immobilier, par contre, visent un portefeuille diversifié avec des revenus sécurisés. Mais les différences entre les trois véhicules ne s’arrêtent pas là ! Le tableau comparatif ci-dessous reprend les principales caractéristiques de chacun.La diversification, un atout majeur dans la performance

Cela étant, en vue du contexte actuel où la vague massive de confinement a donné un coup d’accélérateur à la pratique du télétravail et au recours à l’e-commerce, la sous-occupation des locaux commerciaux et la diminution des investissements dédiés à la location des bureaux risquent de s’intensifier dans les années à venir. Les fonds immobiliers traditionnels seront les premiers à pâtir à moyen terme des conséquences de la crise sanitaire. Il vaut mieux dès lors miser sur des fonds immobiliers qui ont su mettre en œuvre une diversification à la fois géographique et sectorielle en amont de cette crise.C’est l’approche adoptée par les FIA en Immobilier, comme Cacik Fund[1] proposé par Unik Capital Solutions. Outre un respect des fondamentaux – l’emplacement, la qualité des locataires et un bail ferme de longue durée -, Cacik Fund se distingue par une diversification très poussée et une grande flexibilité. Le fonds sélectionne uniquement des secteurs dont les études ont pu démontrer leur stabilité, à savoir les surfaces alimentaires de proximité, la logistique e-commerce et les résidences médicalisées, destinées notamment à accueillir des personnes âgées en situation de perte d’autonomie. Lorsqu’un des secteurs est touché par une crise, le fonds, grâce à des décisions en mode agile de son comité d’investissements, est capable de rééquilibrer rapidement le portefeuille.

Ainsi, suite à la pandémie du coronavirus, les projets dans l’industrie du tourisme restent étudiés mais de manière très opportuniste et l’accent est mis sur les trois autres secteurs d’activité qui ont prouvé leur résilience tout au long de cette crise.

[1] Cacik Fund SCA SICAV-SIF est proposé par Unik Capital Solutions et géré par une AIFM à Luxembourg.